Exchange Traded Funds(ETF)

Keywords:

Entrepreneur

Better life

What to do

Money

Apr 15, 2020

Exchange Traded Funds(ETF) are a simple and straight forward way for individuals to make money on the stock market.

With ETF, there is no reason to complain that the stock market bubble is only available to the rich. Anyone can grow their money using ETF’s from the comfort of their home armed with knowledge and smartphone app(or website).

Exchange Traded Funds(ETF) are a simple and straight forward way for individuals to make money on the stock market.

With ETF's, there is no reason to complain that the stock market bubble is only available to the rich. Anyone can grow their money using ETF’s from the comfort of their home armed with knowledge and smartphone app(or website).

Individuals can make money from the comfort of their home without relying on anyone else's expertise or honesty.

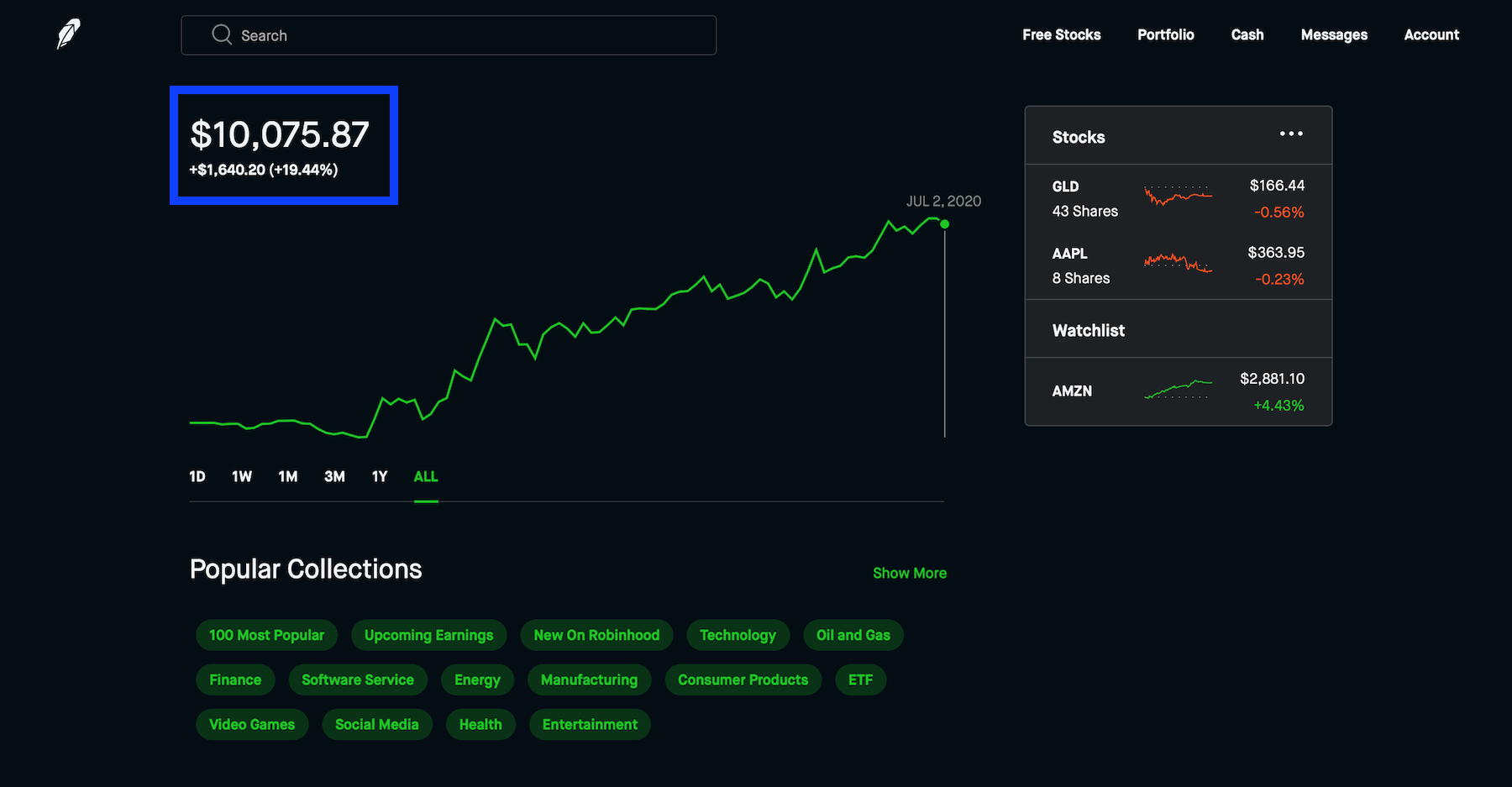

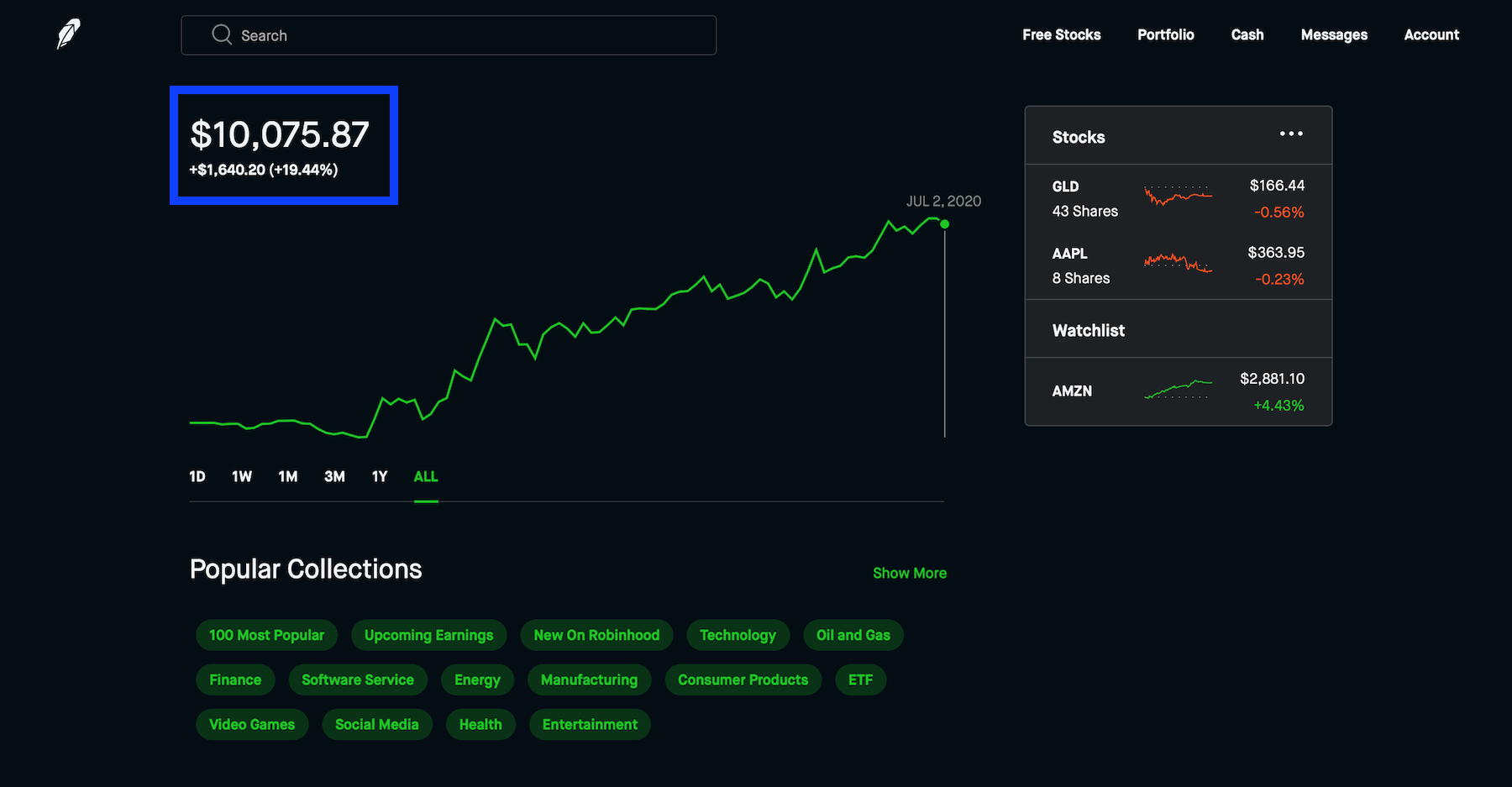

Most savings account offer 2-3% interest rate. ETF’s offer a simple way to get a return of 10% or more irrespective of the amount of money you invest. You can start as small as you want. See screenshot below where the author demonstrates making 10.7% return in 1 month. This was done during turbulent times in the stock market between Mar-Apr 2020.

Do you have a few hundred dollars spare in your savings account giving you 2-3% interest? Invest in ETF with an app. See this as a challenge to grow your few hundred dollars, and force yourself to get a better understanding of the macro-economic trends.

In simple terms,

Exchange Traded Funds(ETF) is trading individual stocks or a group of stocks yourself on the stock market without any middleman to advise or guide you.

ETF’s are known and traded by their symbol. As an example, the popular

Vanguard S&P 500 ETF(symbol VOO) allows you to buy share of top 500 stocks in US Stock market. This is a good investment if you expect the US Stock market to generally do well.

GLD ETF tracks the price of gold.

Mutual Funds are different from ETF’s. Mutual Funds are professionally managed and have fees associated with them. You can’t trade individual stocks in mutual funds. E.g. if you think the stock price of Apple is going to go up, you can’t trade exclusively in Apple stock using mutual funds. However, there are technology-focused mutual funds that could include shares of Apple.

The

advantages of ETF’s over Mutual Funds are: no management fees or overheads with ETF’s as you manage them yourself, flexibility to buy individual stocks or groups of stocks, no minimum investment required, and you can trade in them instantly without any delay.

The advantages of ETF’s over buying individual stock is that you can also buy a group of stocks to spread the risks with ETF.

The disadvantage of ETF’s over mutual funds is that you have to manage ETF’s yourself. This is less of an issue as most ETF’s can be easily managed via an app or website. You and you alone are responsible for buying and selling it at the right time. If an ETF is low, you have to decide to buy it. If an ETF is high, you have to decide to sell it.

ETF is the right investment for you if you want to start small, want to learn and manage it yourself, and have time to monitor the economic environment and stock market trends yourself.

ETF is

not right for you if you are overwhelmed with your daily life, are not disciplined, don’t read, make excuses, don't want to learn, don’t follow the financial news, and can’t predict macro stock market trends.

Individual investors are usually the worst performing investors as they generally are not disciplined to follow stock market trends, and are distracted.

The knowledge and tools are free and available to all. It is

discipline and hard work that will make you successful. There are no shortcuts here.

As an example, if you understand at the time of writing that Gold and Apple stocks will do well in the next few months, then ETF’s are for you. If you can see at the time of writing that Google, Facebook, Oil and commodities, Oil companies, and Airlines will

not do well, then ETF’s are for you. If you can’t understand this, then ETF's is

not for you.

You need an

ETF broker to buy and sell ETF's. There are ETF brokers that allow you to buy and sell ETF’s commission-free via their website or app.

It is not necessary to know how an ETF broker can allow you to buy and sell ETF's for free. The cost of trading in ETF is very low. The ETF broker needs to only make a small amount of money off their customers to be profitable. However, if you are curious, ETF brokers make money by:

- If you decide to buy Gold stock(ETF symbol GLD). ETF broker will buy it immediately, but you will not get it until the money is transferred. The price of GLD could go up in this time. So the ETF broker can buy low, and sell you later.

- It can take 3-5 days for money to be available when you transfer money to ETF broker. The ETF broker holds on to this money and earns interest on this money for the few days.

- Investors generally leave un-invested cash in their accounts with ETF broker. ETF brokers can get interest off this un-invested cash in their account.

- Freemium model: ETF brokers expect/hope you buy other more expensive products when you come to buy ETF’s.

The only other cost with ETF’s is that you

have to pay taxes on the profits when you sell the ETF and cash them out. E.g. if you invest $1000 in ETF, and sell the ETF later for $1200, you have to

pay income tax on the $200 profit. You only pay tax on the profit when you sell. Your ETF broker will send you end of the year tax statement showing the profit you made and tax due. It is the same process with Savings Accounts, Mutual Funds, and individual stocks.

There are several commission-free ETF brokers e.g.

Robinhood,

Charles Schwab,

TD Ameritrade,

Vanguard,

Ally Invest.

Robinhood is the one I have used and is simple and popular.

Robinhood offers an

app and

website. Robinhood allows individuals to trade in ETF's without paying commission. One notable shortcoming of Robinhood is that there is a 3-5 days delay before the money is available for trading. E.g. if you transfer $5000 from your bank to Robinhood, the money can take 5-7 days to arrive. You can miss out on great opportunities while waiting for the money to arrive. This is because Robinhood makes money from the interest during this time while they hold your money. Robinhood also offers up to $1000 instant credit when you transfer money. You can use this money to trade. This offsets part of the delay when trading on Robinhood.

Free ETF broker apps like Robinhood are a good choice for long term ETF trading. They are

not suitable for short term ETF investing or overnight success.

Buying and selling ETF commission-free is easy with Robinhood. However, it is you who has to decide when to buy and sell.

Awareness of stock market trends and understanding the risks is critical before you buy and sell ETF’s.

Caveat emptor: buyer aware. You are responsible for checking the suitability of products before you buy. This is not investment advice but my personal experience.

* * *

The screenshot below shows the author making 19.44% return in 5 month(~$1640 return with ~$8500 investment) during turbulent times in the stock market from Feb-Jul 2020 by buying gold GLD ETF and AAPL stock using the Robinhood app.

Exchange Traded Funds(ETF) are a simple and straight forward way for individuals to make money on the stock market. Anyone can grow their money using ETF’s from the comfort of their home armed with knowledge and smartphone app(or website).

Related articles

The world needs authentic Capitalism, not Socialism

Pursue money and power like your life depends on it

External Links